Ghosted by a Customer, What Do You Do?—EP 215

I’m dealing with a customer right now who seems interested in some CNC machines Graff-Pinkert has for sale. They told me they needed this type of machine ASAP! And these machines are RARE! They even said they had a big job for the machines already and they are on the

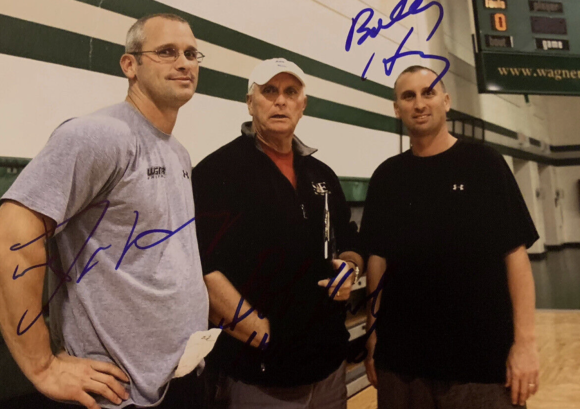

Basketball Family Business

The NCAA Basketball Tournament, the less popular Men’s part, crowned the University of Connecticut as Champion for the second straight year. UConn didn’t just beat

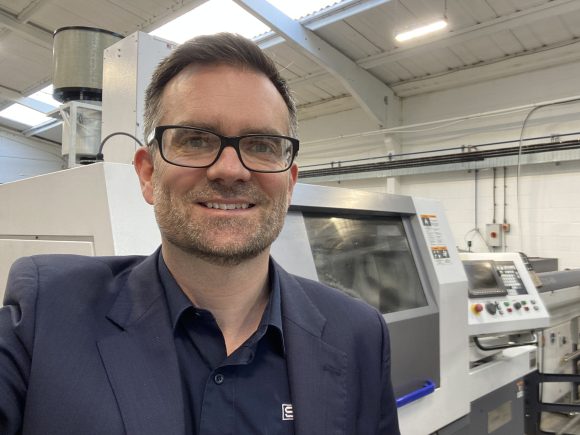

Leaving your Father’s Manufacturing Company and then Founding Your Own, with Howard Sheldon-EP 214

Our guest on today’s show, Howard Sheldon, grew up working in his family’s third generation precision turning company. He planned to eventually take over the

He Would Have Thrown Away This Blog

Danny Kahneman died a week ago at the age of 90. He won a Nobel Prize for Economics but always saw himself as a psychologist.

Take Me Back to the Ball Game?

“Take me out to the ball game…. Buy me some peanuts and crackerjack. I don’t care if I ever come back!” Opening Day. It’s tomorrow.

Supplying Medical Parts Directly to Hospitals, with Thadd Mellott-EP 213

My guest on today’s show, Thadd Mellott, called us at Graff-Pinkert because he needed a Star SB20 CNC Swiss machine. His company, Circle M Spring,

Moving Ain’t Easy

I was in my early 40s, my son Noah’s age. when we built the 20,000-square-foot home of our machine tool business, over 30 years ago.